Contents:

Investments in T-bills involve a variety of risks, including credit risk, interest rate risk, and liquidity risk. As a general rule, the price of a T-bills moves inversely to changes in interest rates. Atlantic Capital Bancshares, Inc. offers personal and commercial banking products and services. The company was founded in 2006 and is based in Atlanta, Georgia.

As an investor, you want to buy stocks with the highest probability of success. That means you want to buy stocks with a Zacks Rank #1 or #2, Strong Buy or Buy, which also has a Score of an A or a B in your personal trading style. Our clearing firm Apex Clearing Corp has purchased an additional insurance policy. Similar to SIPC protection, this additional insurance does not protect against a loss in the market value of securities. U.S. Treasuries (“T-Bill“) investing services on the Public Platform are offered by Jiko Securities, Inc. (“JSI”), a registered broker-dealer and member of FINRA & SIPC.

© 2020 Market data provided is at least 15-minutes delayed and hosted by Barchart Solutions. Estimates are not provided for securities with less than 5 consecutive payouts. If the last five payouts show variability and are not all growing, we estimate future payouts by applying the lowest growth rate to the most recent payment.

Securities products offered by Open to the Public Investing are not FDIC insured. Apex Clearing Corporation, our clearing firm, has additional insurance coverage in excess of the regular SIPC limits. Passively-managed funds do not typically buy options, so the put/call ratio indicator more closely tracks the sentiment of actively-managed funds. The Fund Sentiment https://day-trading.info/ Score finds the stocks that are being most bought by funds. It is the result of a sophisticated, multi-factor quantitative model that identifies companies with the highest levels of institutional accumulation. The scoring model uses a combination of the total increase in disclosed owners, the changes in portfolio allocations in those owners and other metrics.

Many «beginner» or «novice» investors will look at one stock trading at a price of $10 per share and another trading at a price of $20 per share and think the latter company is worth twice as much. Of course, that is a completely meaningless comparison without also knowing how many shares outstanding there are for each of the two companies. Furthermore, via issuance of new shares over time, or the repurchase of existing shares, the number of shares outstanding can fluctuate over the course of history.

Trading Halts

Please note that delisted stocks are often considered to be more risky investments, as they are no longer subject to the same regulatory and reporting requirements as listed stocks. Therefore, it is essential to carefully research the Atlantic Capital’s history and understand the potential risks before investing. The yearly return on the ACBI stock yearly return page and across the coverage universe of our site, is a measure of the annual return over the calendar year 2020 for the given stock.

One share of ACBI stock can currently be purchased for approximately $32.34. Even with the recent run-up in bank stocks, there are still plenty of compelling opportunities in the sector, Truist says. Your browser of choice has not been tested for use with Barchart.com.

Related Companies

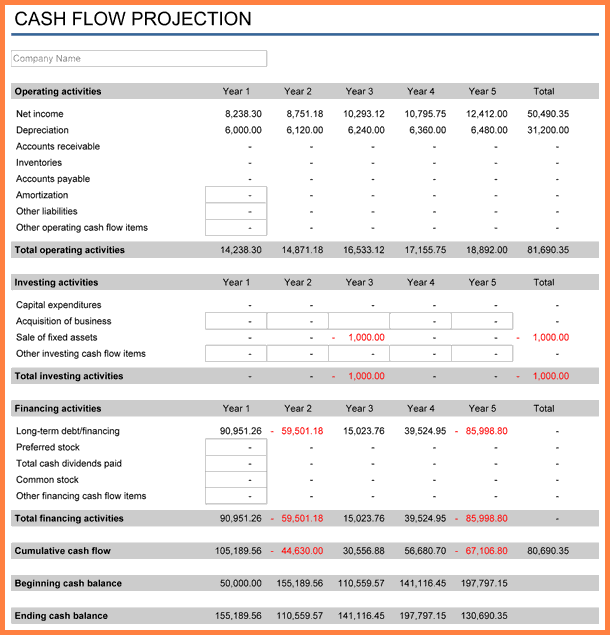

The chart below illustrates the average year performance for Atlantic Capital . Some sectors tend to outperform during certain parts of the year. Certain financial information included in Dividend.com is proprietary to Mergent, Inc. («Mergent») Copyright © 2014. See Best Dividend Protection Stocks Model Portfolio for our top retirement income ideas. See Best High Dividend Stocks Model Portfolio for our top maximize income ideas.

Below section compares how Atlantic Capital Bancshares Inc has performed compared to other Small-cap stocks in general. We have compared the closing prices of Atlantic Capital Bancshares Inc against the Dow Jones Small Cap index. The calculated value is the past 10-year return (computed for 7-year available data from 10-year observation window) of Atlantic Capital Bancshares Inc . If you want to know the returns for the ongoing year visit the, 2022 performance report of ACBI stock. If you want to invest in stocks and be successful, you have to do your analysis. To help your analysis, this report gives you various insights from past 10-year performance of Atlantic Capital Bancshares Inc stock in NASDAQ exchange.

- It also serves middle-market and emerging growth companies, private banking clients, and top-tier real estate developers.

- The number ranges from 0 to 100, with higher numbers indicating a higher level of accumulation to its peers, and 50 being the average.

- Through its Fintech, Payments and Treasury Services teams, Co. provides an array of payment processing solutions, treasury management and deposit services to companies located throughout the U.S.

- Of course, that is a completely meaningless comparison without also knowing how many shares outstanding there are for each of the two companies.

When performing this calculation it is important to factor in dividends, because a financial instrument’s annual return is more than just the change in price if that instrument pays a dividend or coupon. Fundamental data of companies, historical data, daily updates, financial statements, dividend data and index data are provided by S&P Global Market Intelligence. Brokerage services for alternative assets available on Public are offered by Dalmore Group, LLC (“Dalmore”), member of FINRA & SIPC. “Alternative assets,” as the term is used at Public, are equity securities that have been issued pursuant to Regulation A of the Securities Act of (“Regulation A”). These investments are speculative, involve substantial risks , and are not FDIC or SIPC insured.

Please read the Characteristics and Risks of Standardized Options before trading options. JSI uses funds from your Treasury Account to purchase T-bills in increments of $100 “par value” (the T-bill’s value at maturity). The value of T-bills fluctuate and investors may receive more or less than their original investments if sold prior to maturity. T-bills are subject to price change and availability – yield is subject to change.

Market Data Product Matrix

The best time to be a buyer is when everybody else is running for the exits, and three of Forbes’ top premium investment newsletter editors make the case for contrarian investments ideas. Atlantic Capital corporate directors refer to members of an Atlantic Capital board of directors. The board of directors generally takes responsibility for the Atlantic Capital’s affairs and long-term direction of the entity.

Hopefully, the above report helps you learn about the past ten-year performance of Atlantic Capital Bancshares Inc shares. Kindly use the sections below to suggest corrections or improvements to the report. Let us now see 10 biggest one-day losses of Atlantic Capital Bancshares Inc stock.

Below section compares how Atlantic Capital Bancshares Inc has performed against other companies with similar Market Capitalization. We have compared the closing prices of Atlantic Capital Bancshares Inc against the (), Amalgamated Bank stocks. We have used geometric mean to calculate the average annual return. No offer to buy securities can be accepted, and no part of the purchase price can be received, until an offering statement filed with the SEC has been qualified by the SEC. An indication of interest to purchase securities involves no obligation or commitment of any kind.

You may use StockInvest.us and the contents contained in StockInvest.us solely for your own individual non-commercial and informational purposes only. Any other use, including for any commercial purposes, is strictly prohibited without our express prior written second most traded currency crossword clue, crossword solver consent. Atlantic Capital Bancshares Stock can be purchased through just about any brokerage firm, including online brokerage services. Atlantic Capital Bancshares holds several positive signals, but we still don’t find these to be enough for a buy candidate.

ACBI Stock’s Price Graph & Average Annual Return

• ACBI average annual return 10 yearsAbout Atlantic Capital Bancshares Inc Atlantic Capital Bancshares is a bank holding company. Through its subsidiaries, Co. focuses on serving commercial and not-for-profit enterprises, fintech and other processing companies, commercial real estate developers and individual clients. Through its Fintech, Payments and Treasury Services teams, Co. provides an array of payment processing solutions, treasury management and deposit services to companies located throughout the U.S. As of March 1, 2022, Atlantic Capital Bancshares, Inc. was acquired by SouthState Corporation. Atlantic Capital Bancshares, Inc. operates as the bank holding company for Atlantic Capital Bank, N.A. The company offers non-interest and interest bearing demand, savings and money market, time, and brokered deposits.

One of the popular trading techniques among algorithmic traders is to use market-neutral strategies where every trade hedges away some risk. Because there are two separate transactions required, even if one position performs unexpectedly, the other equity can make up some of the losses. Below are some of the equities that can be combined with Atlantic Capital stock to make a market-neutral strategy. Peer analysis of Atlantic Capital could also be used in its relative valuation, which is a method of valuing Atlantic Capital by comparing valuation metrics with similar companies.

An industry with a larger percentage of Zacks Rank #1’s and #2’s will have a better average Zacks Rank than one with a larger percentage of Zacks Rank #4’s and #5’s. The max supply of Atlantic Capital Bancshares shares is 20.33M. There are multiple ways to fund your Public account—from linking a bank account to making a deposit with a debit card or wire transfer. You can sign up for an account directly on our website or by downloading the Public app for iOS or Android.

Atlantic Capital Bancshares, Inc. (ACBI)

As the price of quarterbacks rises in the NFL, other positions are seeing their value declining in a relative sense. Jaire Alexander was set to count $20.2 million against the cap. Instead, his reworked deal took his cap number down to $10.755 million. The industry with the best average Zacks Rank would be considered the top industry , which would place it in the top 1% of Zacks Ranked Industries. The industry with the worst average Zacks Rank would place in the bottom 1%.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating indiv idual securities. No content on the Webull Financial LLC website shall be considered as a recommendation or solicitation for the purchase or sale of securities, options, or other investment products. All information and data on the website is for reference only and no historical data shall be considered as the basis for judging future trends. Apex Crypto is not a registered broker-dealer or FINRA member and your cryptocurrency holdings are not FDIC or SIPC insured.

Discuss news and analysts’ price predictions with the investor community. We present 13D/G filings separately from the 13F filings because of the different treatement by the SEC. 13D/G filings can be filed by groups of investors , whereas 13F filings cannot. This results in situations where an investor may file a 13D/G reporting one value for the total shares , but then file a 13F reporting a different value for the total shares . This means that share ownership of 13D/G filings and 13F filings are oftentimes not directly comparable, so we present them separately.

Real-time analyst ratings, insider transactions, earnings data, and more. Sign-up to receive the latest news and ratings for Atlantic Capital Bancshares and its competitors with MarketBeat’s FREE daily newsletter. Atlantic Capital Bancshares delivered earnings and revenue surprises of 22.64% and -0.30%, respectively, for the quarter ended September 2021. ATLANTA _ Atlantic Capital Bancshares Inc. on Monday reported fourth-quarter net income of $11.7 million. Live educational sessions using site features to explore today’s markets. Here is the information needed for Atlantic Capital Bancshares shareholders to complete the merger.