Contents:

20 equities research analysts have issued 12 month target prices for Dynatrace’s stock. On average, they predict the company’s stock price to reach $47.11 in the next twelve months. This suggests a possible upside of 13.5% from the stock’s current price. View analysts price targets for DT or view top-rated stocks among Wall Street analysts.

- Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only.

- Dynatrace has a short interest ratio («days to cover») of 3, which is generally considered an acceptable ratio of short interest to trading volume.

- Reports are indicating that there were more than several insider trading activities at DT starting from Pace Stephen J., who sale 15,812 shares at the price of $42.27 back on Mar 01.

Each bar represents the previous year of ratings for that month. Within each bar, the sell ratings are shown in red, the hold ratings are shown in yellow, the buy ratings are shown in green, and the strong buy ratings are shown in dark green. Intraday Data provided by FACTSET and subject to terms of use.

Analyst’s Opinion

Other institutional investors also recently made changes to their positions in the company. Wipfli Financial Advisors LLC bought a new stake in shares of Dynatrace during the third quarter valued at approximately $30,000. Acquired a new stake in Dynatrace in the 3rd quarter valued at approximately $51,000.

The https://1investing.in/ has a market capitalization of $11.94 billion, a P/E ratio of 413.00, a P/E/G ratio of 4.30 and a beta of 1.11. The company has a 50 day simple moving average of $41.80 and a 200-day simple moving average of $38.30. Dynatrace, Inc. has a 1 year low of $29.41 and a 1 year high of $48.00. Reports are indicating that there were more than several insider trading activities at DT starting from Pace Stephen J., who sale 15,812 shares at the price of $42.27 back on Mar 01. Now owns 120,923 shares of Dynatrace Inc., valued at $668,378 using the latest closing price. We have a positive outlook on Dynatrace’s prospects in the observability space.

DT price to earnings (PE)

Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only. Intraday data delayed at least 15 minutes or per exchange requirements. At its annual Perform conference, Dynatrace announced key updates for its software intelligence platform, including a new AutomationEngine. According to 34 analysts, the average rating for DT stock is «Buy.» The 12-month stock price forecast is $49.76, which is an increase of 19.88% from the latest price. Real-time analyst ratings, insider transactions, earnings data, and more.

Have Insiders Sold Dynatrace, Inc. (NYSE:DT) Shares Recently? – Simply Wall St

Have Insiders Sold Dynatrace, Inc. (NYSE:DT) Shares Recently?.

Posted: Thu, 23 Feb 2023 08:00:00 GMT

On August 1, 2019, Dynatrace completed its initial public offering. Dynatrace was founded by Bernd Greifeneder on February 2, 2005 in Linz, Austria as dynaTrace Software GmbH, and was acquired by Compuware in 2011. In 2014, the private equity firm Thoma Bravo took the company private, and the Compuware APM group was renamed Dynatrace. Dynatrace established the Digital Performance Management category in late 2014. It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider.

Dynatrace to Report Third Quarter of Fiscal 2023 Financial Results

The Pipeline segment includes interstate pipelines, intrastate pipelines, storage systems, lateral pipelines including related treatment plants and compression and surface facilities. The Gatherings segment focuses on the gathering systems, related treatment plants, and compression and surface facilities. The company was founded on November 20, 2007, and is headquartered in Detroit, MI.

And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data. CompareDT’s historical performanceagainst its industry peers and the overall market. Style is an investment factor that has a meaningful impact on investment risk and returns. Style is calculated by combining value and growth scores, which are first individually calculated. Volatility profiles based on trailing-three-year calculations of the standard deviation of service investment returns. Dynatrace offers AI-powered systems management solutions for businesses.

Investors’ optimism about the company’s current quarter earnings report is understandable. Analysts have predicted the quarterly earnings per share to grow by $0.22 per share this quarter, however they have predicted annual earnings per share of $0.87 for 2023 and $0.99 for 2024. It means analysts are expecting annual earnings per share growth of 27.90% this year and 13.80% next year. According to projections from Statista, 79 zettabytes of data – or 79 trillion gigabytes – will be created in 2021. That’s twice the amount of data produced just two years ago, and growth at this pace is forecasted to continue into the foreseeable future. Market capitalization is calculated by taking a company’s share price and multiplying it by the total number of shares.

It operates bottleneck, a platform for running and optimizing multi-cloud environments. DT has been the subject of a number of recent research reports. Wedbush assumed coverage on Dynatrace in a research report on Wednesday, December 14th. They set a “neutral” rating and a $35.00 price objective for the company.

Dynatrace CEO, Rick McConnell, On Why Observability Matters And How Its Unique

WatchPerform 2020, because the world needs software to work perfectly. All investments involve risk, and not all risks are suitable for every investor. The value of securities may fluctuate and as a result, clients may lose more than their original investment. The past performance of a security, or financial product does not guarantee future results or returns. Keep in mind that while diversification may help spread risk, it does not assure a profit or protect against loss in a down market. There is always the potential of losing money when you invest in securities or other financial products.

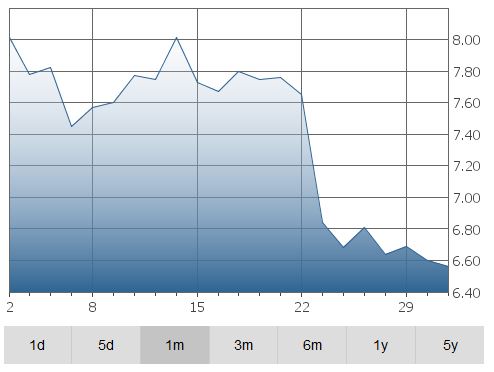

This puts John Van Siclen in the top 30% of approval ratings compared to other CEOs of publicly-traded companies. Dynatrace has been the subject of 14 research reports in the past 90 days, demonstrating strong analyst interest in this stock. The company’s average rating score is 2.70, and is based on 14 buy ratings, 6 hold ratings, and no sell ratings. A valuation method that multiplies the price of a company’s stock by the total number of outstanding shares. After a stumble in the market that brought DT to its low price for the period of the last 52 weeks, the company was unable to rebound, for now settling with -14.58% of loss for the given period. Wedbush gave a rating of “Neutral” to DT, setting the target price at $35 in the report published on December 15th of the previous year.

The firm has a market capitalization of $11.94 billion, a price-to-earnings ratio of 413.00, a price-to-earnings-growth ratio of 4.30 and a beta of 1.11. The stock’s fifty day moving average is $41.80 and its two-hundred day moving average is $38.30. The chart below shows how a company’s share price and consensus price target have changed over time. The lighter blue line represents the stock’s consensus price target. The even lighter blue range in the background of the two lines represents the low price target and the high price target for each stock. The Dynatrace platform provides observability of the full solution stack in order to simplify the complexity of cloud native computing and accelerate an organization’s digital transformation and cloud migration.

Provide specific products and services to you, such as portfolio management or data aggregation. A stock’s beta measures how closely tied its price movements have been to the performance of the overall market. DT Midstream, Inc. engages in the operation and development of natural gas midstream interstate and intrastate pipelines, storage and gathering systems, and compression, treatment and surface facilities.

Free trading of stocks, ETFs, and options refers to $0 commissions for Webull Financial LLC self-directed individual cash or margin brokerage accounts and IRAs that trade U.S. listed securities via mobile devices, desktop or website products. Advisory accounts and services are provided by Webull Advisors LLC (also known as «Webull Advisors»). Webull Advisors is an Investment Advisor registered with and regulated by the SEC under the Investment Advisors Act of 1940.

High-growth stocks tend to represent the technology, healthcare, and communications sectors. They rarely distribute dividends to shareholders, opting for reinvestment in their businesses. More value-oriented stocks tend to represent financial services, utilities, and energy stocks. A company’s earnings reviews provide a brief indication of a stock’s direction in the short term, where in the case of Dynatrace Inc. No upward and no downward comments were posted in the last 7 days.